Factors to Consider Before Investing in Rehab Property

At ZLD Partners, we know that investing in rehab properties can be a highly rewarding venture. However, it involves a fair share of challenges and complexities. Whether you’re a seasoned investor or just starting out, it’s crucial to weigh all the important factors before making your move. Let’s look at the key considerations to ensure your investment is a success.

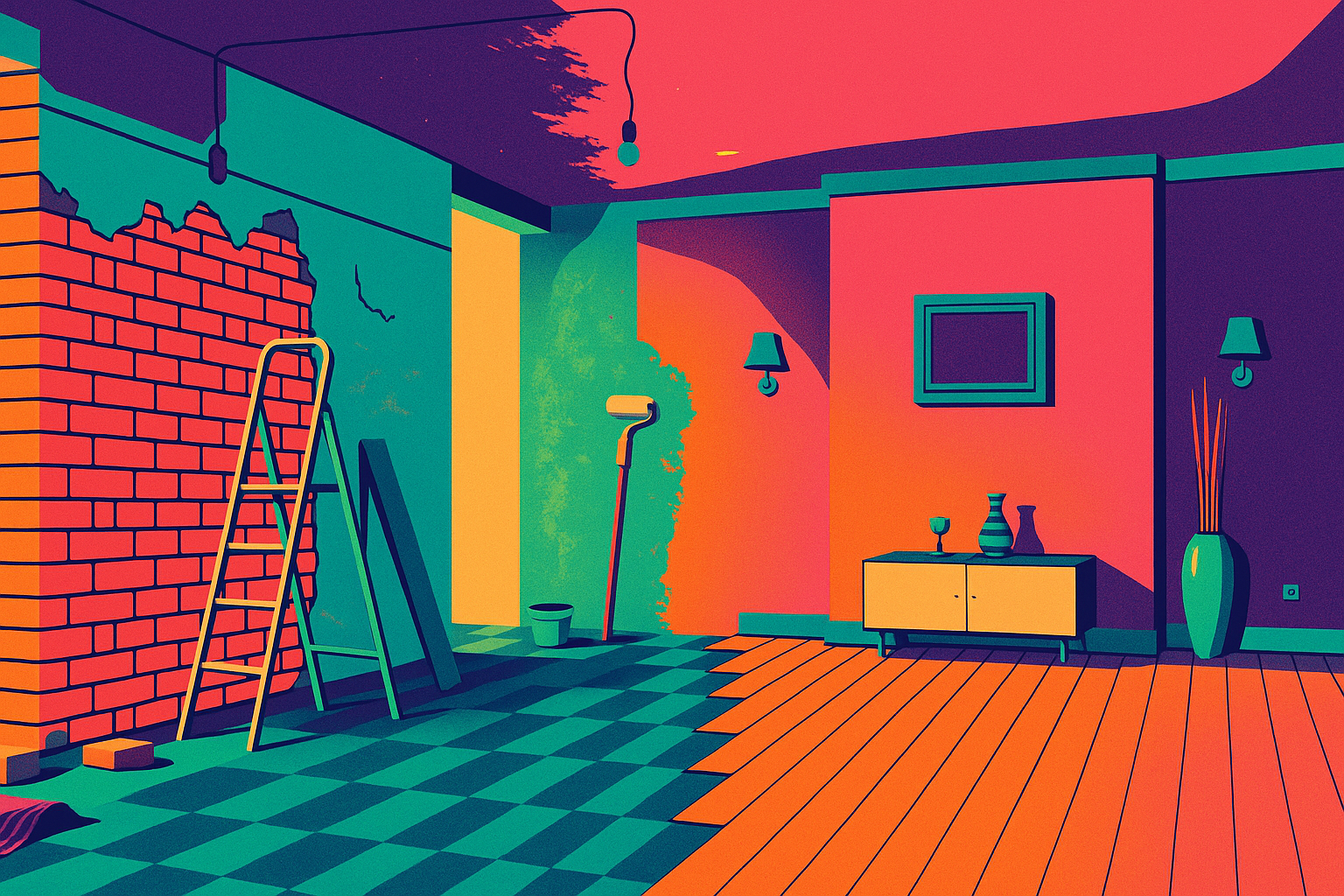

1. Cost of Renovations

One of the first and most critical aspects to consider is the true cost of renovations. It’s not just about patching up the visible issues like broken tiles or peeling paint; you also need to anticipate the hidden problems that might surface once the project is underway. This could include outdated plumbing, electrical issues, or structural deficiencies that are only apparent after you open up walls or floors. We always recommend a thorough pre-purchase inspection by a qualified professional. This will give you a clearer idea of what lies ahead and help you build a more realistic budget that accounts for both expected and unexpected expenses.

2. After Repair Value

The After Repair Value is the estimated market value of the property after renovations are complete. Accurately calculating the ARV is essential, as it helps determine whether your investment will ultimately be profitable. Don’t just rely on a gut feeling or a ballpark figure, take the time to analyze recent sales of similar, renovated properties in the same neighborhood. At ZLD Partners, we recommend working with a real estate agent who knows the area well or using a reliable real estate data platform. A clear understanding of ARV can help you avoid overpaying for a property that might not deliver the returns you’re aiming for.

3. Financing Options

Rehab properties often don’t qualify for traditional financing because of their condition. This means you’ll likely need to explore alternative funding sources such as hard money loans, private lenders, or even cash partners. These types of financing can come with higher interest rates and shorter repayment periods, so it’s crucial to understand the terms and conditions before signing any agreements. We always recommends taking a close look at the lender’s requirements, including any fees or prepayment penalties, to ensure you’re making a sound financial decision.

4. Timeframe for Completion

Renovations rarely go exactly as planned. Delays are common due to weather, permitting issues, contractor availability, or unexpected structural problems. That’s why it’s essential to build a realistic timeline and be prepared for some flexibility. Don’t forget to factor in carrying costs during the rehab period, such as mortgage payments, utilities, property taxes, and insurance. These ongoing expenses can quickly eat into your projected profits if the project drags on. We stress the importance of having a clear plan and a financial cushion to cover these costs.

5. Local Market Conditions

The profitability of your rehab investment can be heavily influenced by the local market. Are property values in the neighborhood rising, stable, or falling? How quickly are homes selling in the area? Are there new developments or infrastructure projects that could boost demand? Understanding these trends can help you time your purchase and sale to maximize returns. ZLD Partners has access to the latest market data and insights, and we encourage all our clients to do a thorough market analysis before moving forward.

6. Skill and Experience

Rehabbing properties requires more than just money, it demands knowledge, skill, and experience. From understanding building codes to managing contractors and navigating inspections, the process can be overwhelming if you’re not prepared. If you’re new to the rehab game, consider partnering with someone who has experience, or start with a smaller project to learn the ropes. We’ve seen that success often comes from leveraging the skills of trusted professionals and being realistic about your own capabilities.

7. Potential for Return on Investment

At the end of the day, every investor wants to know: Will this project deliver a worthwhile return? To answer this, calculate all the costs involved, purchase price, renovation expenses, carrying costs, and financing charges. Then compare this total to your estimated ARV to see if there’s enough profit margin to justify the risk. Don’t forget to account for selling costs like agent commissions and closing fees. ZLD recommends building in a healthy cushion for unexpected costs, so you’re not left scrambling if your budget overruns.

8. Legal and Environmental Considerations

Rehab projects can be subject to a maze of legal and environmental requirements. Local zoning laws, permitting processes, and building codes can all affect your plans, so make sure you’re fully compliant before starting work. Additionally, older properties might contain hazardous materials like lead paint, asbestos, or mold, which require professional remediation. Ignoring these issues can result in costly fines or even legal action. We always recommend consulting with an attorney or environmental specialist to ensure your investment stays above board.

Rehabbing properties can be a great way to build wealth and revitalize communities, but it’s not without its challenges. By considering these key factors and working with experienced professionals, you can set yourself up for a successful and profitable investment. We’re here to help you navigate every step of the process.

Contact us to learn more about how we can support your next project!